A wide range of financial incentives are available to businesses that start, expand, or relocate to Jackson County, Illinois. If you are interested in relocating or expanding your business in Jackson County, please contact us and we will work with our local and state partners to share available opportunities. Ample grant funds are also available for businesses in Jackson County, Illinois for equipment, land acquisition, construction, and public infrastructure improvements.

Financial incentives include:

Enterprise Zone:

The Jackson County Enterprise Zone is a broader zone jointly created by the City of Murphysboro, the City of Carbondale, and Jackson County, and authorized by the Illinois Department of Commerce and Economic Opportunity in 2020. Incentives include abatement of property tax on new improvements, deduction of sales tax for building materials, waiver of building permit fees, and state of Illinois tax incentives. If you have questions about Jackson County’s Enterprise Zone, please contact: Steven Mitchell City of Carbondale 200 South Illinois Avenue Carbondale, Illinois 62902 (618) 457-3286 steven.mitchell@explorecarbondale.com www.explorecarbondale.com

Opportunity Zone:

Investments in opportunity zones are granted federal capital gains tax reductions and/or elimination.

Available Sites

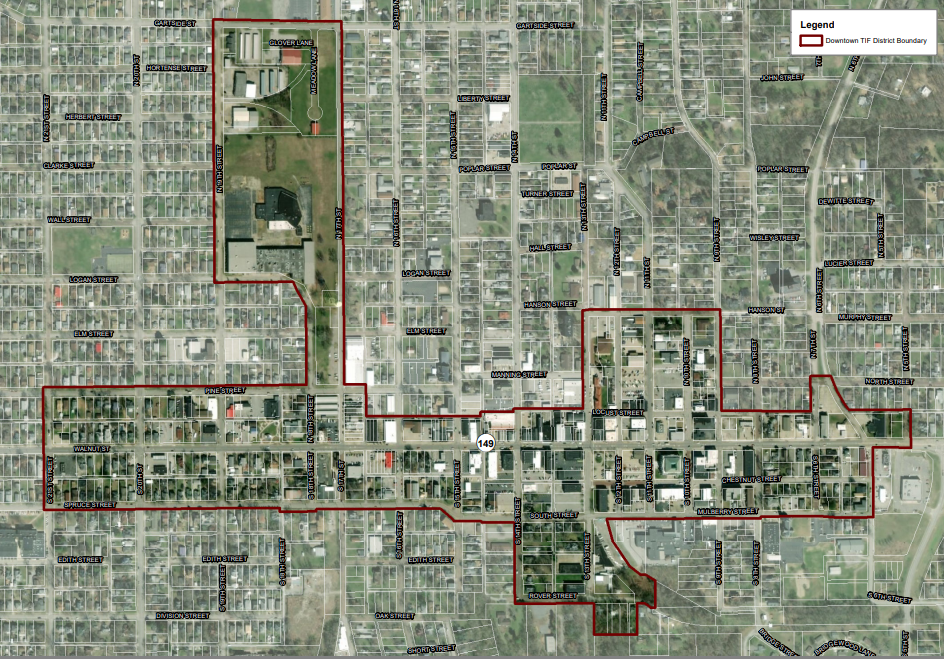

Murphysboro TIF District:

Tax Increment Financing (TIF) Districts:

Developers can be reimbursed for certain expenses using the property tax revenue generated by new development in the TIF district. A map of TIF districts in Carbondale can be found here: https://www.explorecarbondale.com/815/TIF-District

Additional Resources:

JGA Enterprise Zone Incentives